How Much Can You Gift Tax Free 2024 Ireland

How Much Can You Gift Tax Free 2024 Ireland. As a comparison, if you were to gift a child €150,000 as a lump sum when they were 25, it could either be given tax free but reduce the child’s overall lifetime cat. Once due, it is charged at the current rate of 33% (valid from.

There is a significant level of inheritance tax in ireland. How much money can i gift my children?

Inheritance Tax Is Paid On A Person's Estate When They Pass Away.

From 01 january 2022, you can give employees up to two small benefits, tax free, each year.

(That’s Up $1,000 From Last Year’s Limit Since The Gift Tax Is One Of Many Tax Amounts Adjusted Annually For Inflation.).

However, if you have a partner or spouse, they are also entitled to give your father €3,000 tax free a year.

How Much Can You Gift Tax Free 2024 Ireland Images References :

Source: avivahbfelicdad.pages.dev

Source: avivahbfelicdad.pages.dev

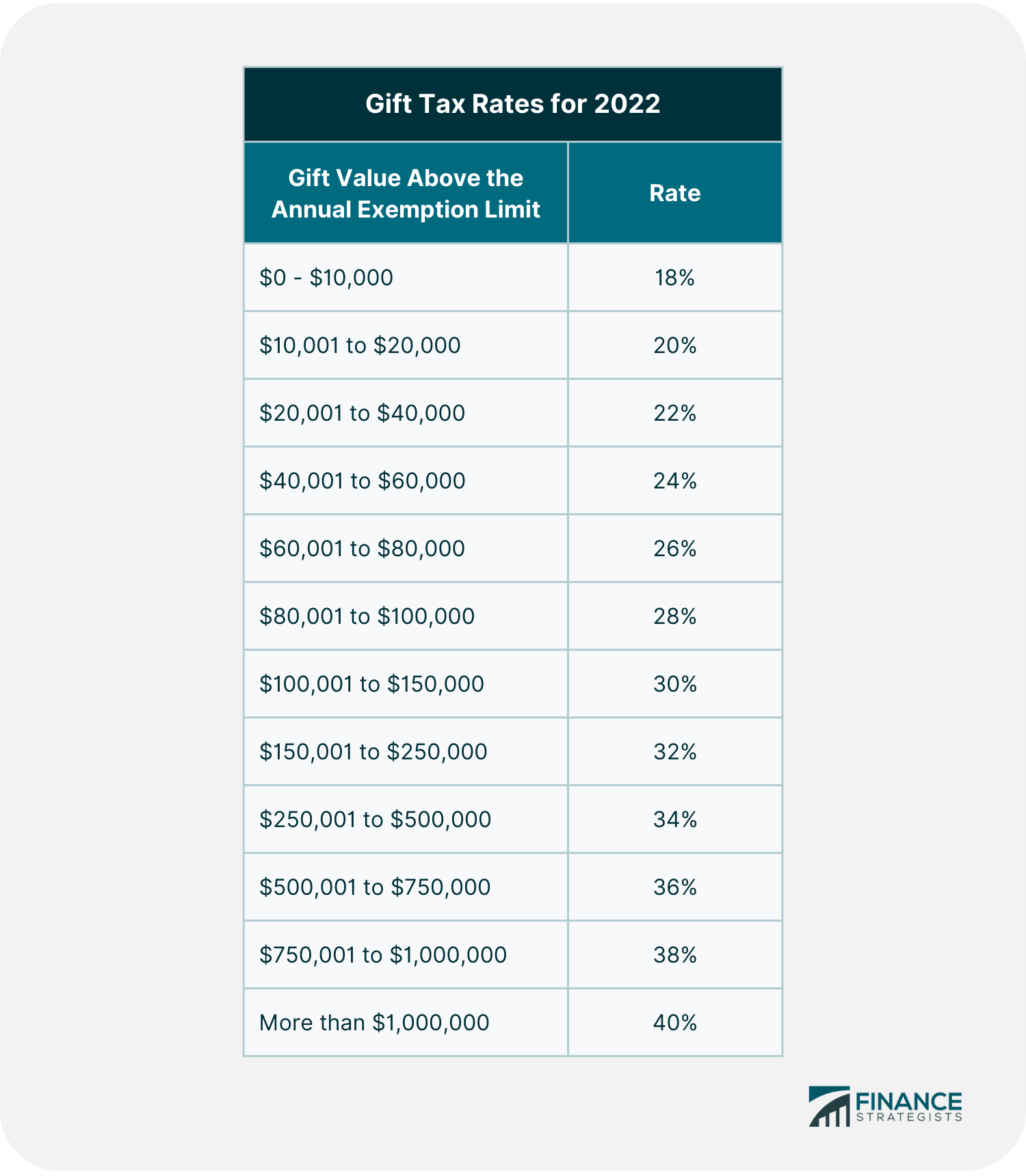

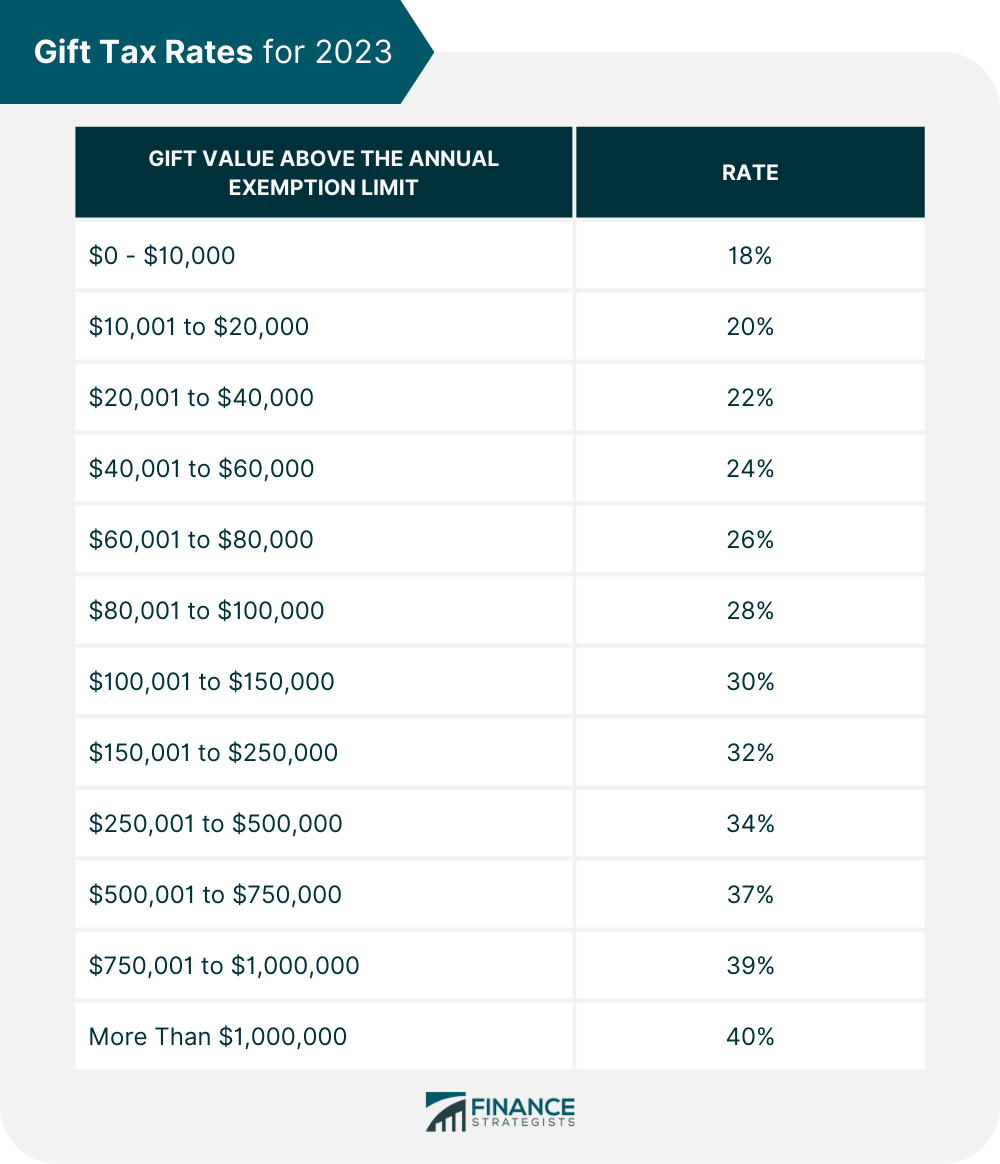

What Is The Gift Tax Rate For 2024 Phaedra, For 2024, the annual gift tax limit is $18,000. Payroll deduction, or a transfer of a gift card that can be redeemed.

Source: imagetou.com

Source: imagetou.com

Gifting Money 2024 Tax Free Image to u, You may receive gifts and inheritances up to a set value over your lifetime before having to pay cat. The top 7.7 per cent of earners pay 54 per cent of all income tax.

Source: darynqofella.pages.dev

Source: darynqofella.pages.dev

How Much Can Be Gifted Tax Free In 2024 Ddene Esmaria, What are the rules surrounding gifting money? You can file your return online through:

Source: abbesydney.pages.dev

Source: abbesydney.pages.dev

How Much Can You Gift Tax Free 2024 Ireland Tedda Mariska, Inheritance tax is paid on a person's estate when they pass away. If you receive a gift or inheritance, you may have to pay tax on it.

Source: paulinawandree.pages.dev

Source: paulinawandree.pages.dev

How Much Can You Gift Tax Free 2024 Vale Alfreda, Here's how capital aquisition tax (cat) works in ireland. However, if you have a partner or spouse, they are also entitled to give your father €3,000 tax free a year.

Source: annalisewagace.pages.dev

Source: annalisewagace.pages.dev

How Much Can You Gift Tax Free 2024 Dody Carleen, That means, for example, that you can gift $18,000 to your cousin, another $18,000 to a friend, another $18,000 to a neighbor, and so on in 2024 without having to. As of my last knowledge update in january.

Source: ceceliawabbie.pages.dev

Source: ceceliawabbie.pages.dev

How Much Money Can You Gift Tax Free 2024 Rana Kalindi, Income tax is high in ireland and predominantly paid by the middle class. Gifts or inheritances you receive from your spouse or civil partner are exempt from gift and inheritance tax.

Source: theresinawdania.pages.dev

Source: theresinawdania.pages.dev

Gifting Tax Free 2024 Angil Brandea, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). You may claim the small gift exemption to give tax free gifts up to.

Source: www.taxsamaritan.com

Source: www.taxsamaritan.com

Foreign Gift Tax Ultimate Insider Info You Need To Know, Increasing the tax threshold before children have to pay inheritance tax to 400,000 will cost €52 million to the exchequer, according the group’s paper. That means, for example, that you can gift $18,000 to your cousin, another $18,000 to a friend, another $18,000 to a neighbor, and so on in 2024 without having to.

Source: www.myxxgirl.com

Source: www.myxxgirl.com

How Much Gift Tax Free Understanding The Basics And Maximizing Tax My, From 01 january 2022, you can give employees up to two small benefits, tax free, each year. How much money can i gift my children?

How And When Do You Pay And File?

Increasing the tax threshold before children have to pay inheritance tax to 400,000 will cost €52 million to the exchequer, according the group’s paper.

The Tax Is Applicable To All Property In Ireland, And The Standard Rate For 2024 Is 33%.

50,000 per annum are exempt from tax in india.

Category: 2024